Does Any Drug Co in the Us Plan to Manfacture Isoprolol Again

On November 19, 2021, the House of Representatives passed H.R. 5376, the Build Back Better Act (BBBA), which includes a broad packet of health, social, and environmental proposals supported past President Biden. The BBBA includes several provisions that would lower prescription drug costs for people with Medicare and private insurance and reduce drug spending by the federal regime and private payers. These proposals have taken shape among strong bipartisan, public back up for the government to address loftier and ascension drug prices. CBO estimates that the drug pricing provisions in the BBBA would reduce the federal arrears by $297 billion over 10 years (2022-2031).

The key prescription drug proposals included in the BBBA would:

- Let the federal government to negotiate prices for some high-price drugs covered under Medicare Part B and Part D

- Require aggrandizement rebates to limit annual increases in drug prices in Medicare and private insurance

- Cap out-of-pocket spending for Medicare Part D enrollees and other Part D benefit design changes

- Limit cost sharing for insulin for people with Medicare and individual insurance

- Eliminate cost sharing for developed vaccines covered under Part D

- Repeal the Trump Administration's drug rebate rule

This brief summarizes these provisions and discusses the expected furnishings on people, program spending, and drug prices and innovation. We contain the estimated budgetary effects released by CBO on November xviii, 2021, and to provide additional context for agreement the expected budgetary effects, we indicate to past projections of like legislative proposals from CBO and others. This summary is based on the legislative language included in the Firm-passed bill that may be modified equally it moves through the Senate.

Permit the Federal Government to Negotiate Prices for Some Loftier-Price Drugs Covered Under Medicare Role B and Part D

Under the Medicare Part D program, which covers retail prescription drugs, Medicare contracts with private plan sponsors to provide a prescription drug benefit. The law that established the Office D benefit includes a provision known as the "noninterference" clause, which stipulates that the HHS Secretary "may non interfere with the negotiations between drug manufacturers and pharmacies and PDP [prescription drug program] sponsors, and may non crave a item formulary or constitute a price structure for the reimbursement of covered part D drugs." In add-on, under current police, the Secretarial assistant of HHS does not negotiate prices for drugs covered under Medicare Part B (administered past physicians). Instead, Medicare reimburses providers based on a formula set at 106% of the Average Sales Price (ASP), which is the boilerplate cost to all not-federal purchasers in the U.South, inclusive of rebates.

The Part D not-interference clause has been a longstanding target for some policymakers because information technology limits the power of the federal government to leverage lower prices, particularly for high-priced drugs without competitors. And with the rise in the number of high-priced drugs coming to market, including the recently-approved Alzheimer'southward drug priced at $56,000, which would be covered under Part B, at that place is renewed interest in proposals to allow the federal authorities to negotiate drug prices for Medicare beneficiaries. A recent KFF Tracking Poll finds large majorities back up allowing the federal government to negotiate and this back up holds steady even later the public is provided the arguments being presented by parties on both sides of the legislative argue.

Provision Description

The BBBA would amend the not-interference clause by adding an exception that would allow the federal regime to negotiate prices with drug companies for a small number of high-cost drugs covered under Medicare Office D (starting in 2025) and Part B (starting in 2027). The negotiation process would apply to no more than 10 (in 2025), 15 (in 2026 and 2027), and 20 (in 2028 and afterward years) single-source brand-proper name drugs or biologics that lack generic or biosimilar competitors. These drugs would exist selected from amidst the 50 drugs with the highest total Medicare Part D spending and the 50 drugs with the highest full Medicare Part B spending. The negotiation process would also utilise to all insulin products.

The legislation exempts from negotiation drugs that are less than 9 years (for small-molecule drugs) or 13 years (for biological products, based on the Manager's Subpoena) from their FDA-approval or licensure date. The legislation also exempts "small biotech drugs" from negotiation until 2028, defined as those which account for 1% or less of Function D or Function B spending and business relationship for fourscore% or more of spending under each part on that manufacturer's drugs, equally well as drugs with Medicare spending of less than $200 1000000 in 2021 (increased past the CPI-U for subsequent years) and drugs with an orphan designation as their but FDA-canonical indication.

The proposal establishes an upper limit for the negotiated toll (the "maximum fair price") equal to a percentage of the not-federal average manufacturer price: 75% for pocket-size-molecule drugs more than ix years but less than 12 years beyond approval; 65% for drugs betwixt 12 and 16 years beyond approval or licensure; and 40% for drugs more than 16 years beyond blessing or licensure. Office D drugs with prices negotiated under this proposal, including insulin, would be required to exist covered by all Part D plans. Medicare'southward payment to providers for Part B drugs with prices negotiated under this proposal would exist 106% of the maximum fair toll (rather than 106% of the average sales toll under current law). (In a separate provision of the BBBA, section 13940, Medicare payments to providers for the administration of biosimilar biologic products would be increased to 108% betwixt April i, 2022 through March 31, 2027.)

An excise tax would be levied on drug companies that do not comply with the negotiation procedure. Manufacturers would face up an escalating excise tax on total sales of the drug in question, starting at 65% and increasing by x% every quarter to a maximum of 95%. In addition, manufacturers that refuse to offering an agreed-upon negotiated toll for a selected drug to "a maximum fair price eligible private" (i.east., Medicare beneficiaries enrolled in Function B and/or Role D, depending on the selected drug) or to a provider of services to maximum off-white price eligible individuals (such every bit a doctor or hospital) would pay a ceremonious monetary penalty equal to 10 times the deviation betwixt the price charged and the maximum fair price.

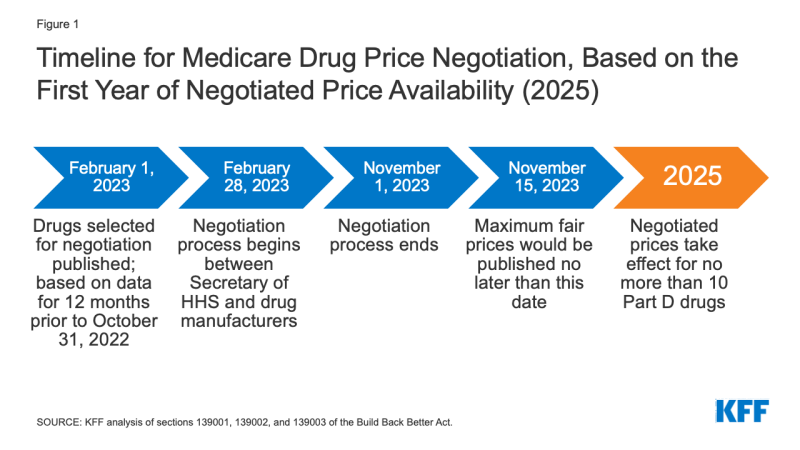

The timeline for the negotiation process spans a roughly ii-year period (Effigy 1). To make negotiated prices bachelor in 2025, the list of selected drugs for negotiation would exist published on February 1, 2023, based on data for a 12-month period prior to October 31, 2022. The menstruation of negotiation betwixt the Secretary and manufacturers of Part D drugs would occur between February 28, 2023 and November 1, 2023, and the negotiated "maximum off-white prices" would be published on the website CMS.gov no later than Nov fifteen, 2023. The initial period of negotiation for Role B drugs would take place between Feb 28, 2025 and November 1, 2025, for prices established for 2027.

Effigy ane: Timeline for Medicare Drug Cost Negotiation, Based on the First Year of Negotiated Cost Availability (2025)

The legislation appropriates 10-year (2022-2031) funding of $iii billion for implementing the drug toll negotiation provisions.

Effective Engagement: The negotiated prices for the get-go ready of selected drugs (covered under Function D) would take effect in 2025. For drugs covered under Part B, negotiated prices would accept effect in 2027.

People affected

The provision to allow the Secretarial assistant to negotiate drug prices would put down pressure on both Part D premiums and out-of-pocket drug costs, although the number of Medicare beneficiaries who would see lower out-of-pocket drug costs in any given twelvemonth nether this provision, and the magnitude of savings, would depend on how many and which drugs were subject to the negotiation procedure and the cost reductions achieved through the negotiations process relative to current prices.

Neither CBO nor the Administration have published estimates of casher premium and out-of-pocket budget furnishings associated with the BBBA proposal to allow the HHS Secretary to negotiate drug prices. An earlier version of the negotiations proposal in H.R.3 that passed the House of Representatives in 2019 would have lowered cost sharing for Part D enrollees past $102.6 billion in the aggregate (2020-2029) and Function D premiums for Medicare beneficiaries by $xiv.3 billion, according to estimates from the CMS Function of the Actuary (OACT). Based on our analysis of the H.R. 3 version of this provision, the negotiations provision in H.R. iii would accept reduced Medicare Part D premiums for Medicare beneficiaries by an estimated 9% of the Part D base of operations beneficiary premium in 2023 and past equally much equally fifteen% in 2029. However, the effects on casher premiums and cost sharing under the drug negotiation provision in the BBBA are expected to exist more minor than the effects of H.R. three due to the smaller number of drugs eligible for negotiation and a different method of calculating the maximum off-white cost.

budgetary touch

CBO estimates $78.8 billion in Medicare savings over x years (2022-2031) from the drug negotiation provisions in the BBBA.

Based on earlier legislation (H.R. three) that would accept allowed the Secretary to negotiate prices for a larger number of drugs and apply negotiated rates to private insurance, CBO estimated over $450 billion in ten-year (2020-2029) savings from the Medicare drug price negotiation provision, including $448 billion in savings to Medicare and $12 billion in savings for subsidized plans in the ACA Market and the Federal Employees Wellness Benefits Program. CBO also estimated an increase in revenues of nearly $45 billion over 10 years resulting from lower drug prices bachelor to employers, which would reduce premiums for employer-sponsored insurance, leading to college compensation in the form of taxable wages.

A divide CBO estimate of the same Medicare drug toll negotiation provision included in another House nib in the 116th Congress (H.R. 1425, the Patient Protection and Affordable Care Enhancement Act) estimated college 10-year (2021-2030) savings of virtually $530 billion, mainly because it would allow the Secretary to negotiate prices for a somewhat larger gear up of drugs in twelvemonth ii of the negotiation program.

Effects on the Evolution of New Drugs

CBO estimates that the drug pricing provisions in the Build Dorsum Improve Act will accept a very modest impact on the number of new drugs coming to market in the U.S. over the next 30 years: 10 fewer out of 1,300, or a reduction of 0.8% (about 1 over the 2022-2031 catamenia, well-nigh four over the subsequent decade, and about 5 over the decade after that). The expected touch on on drug development is more express than suggested by a prior estimate from CBO in part considering the drug price negotiation proposal in the BBBA would affect prices for fewer drugs, and with a different upper limit, than H.R. three. CBO had estimated that a drug toll negotiation proposal along the lines of that which was included in H.R. 3 would lead to ii fewer drugs in the first decade (a reduction of 0.5%), 23 fewer drugs over the next decade (a reduction of v%), and 34 fewer drugs in the tertiary decade (a reduction of 8%).

(Back to peak)

Require Inflation Rebates to Limit Annual Increases in Drug Prices in Medicare and Individual Insurance

Under current law, Medicare has no authorisation to limit annual toll increases for drugs covered nether Part B (which includes those administered past physicians) or Part D. In contrast, Medicaid has a rebate system that requires drug manufacturers to provide refunds if prices grow faster than inflation. Year-to-year drug price increases exceeding inflation are not uncommon and affect people with both Medicare and individual insurance. Our analysis shows that one-half of all covered Office D drugs had listing price increases that exceeded the charge per unit of inflation between 2018 and 2019. A separate analysis by the HHS Office of Inspector General showed average sales price (ASP) increases exceeding inflation for l of 64 studied Part B drugs in 2015.

provision description

The BBBA would require drug manufacturers to pay a rebate to the federal government if their prices for single-source drugs and biologicals covered nether Medicare Part B and nigh all covered drugs under Part D increment faster than the charge per unit of inflation (CPI-U). Nether these provisions, toll changes would be measured based on the average sales cost (for Part B drugs) or the average manufacturer price (for Office D drugs). If price increases are higher than aggrandizement, manufacturers would be required to pay the departure in the form of a rebate to Medicare.

The rebate amount is equal to the total number of units multiplied by the amount if whatsoever by which the manufacturer price exceeds the inflation-adjusted payment amount, including all units sold outside of Medicaid and therefore applying to utilise by Medicare beneficiaries, privately insured, and uninsured individuals. This means drug manufacturers would effectively take to rebate to the government any revenues from cost increases in excess of inflation in Medicare or private insurance plans. Rebate dollars would be deposited in the Medicare Supplementary Medical Insurance (SMI) trust fund.

Manufacturers that exercise not pay the requisite rebate amount would be required to pay a penalty equal to at least 125% of the original rebate amount. The base yr for measuring cumulative price changes relative to inflation is 2021.

The legislation appropriates ten-year (2022-2031) funding of $160 one thousand thousand to the Centers for Medicare & Medicaid Services (CMS) for implementing the inflation rebate provisions ($80 million for Part B and $80 million for Part D).

Effective Engagement: These provisions would take effect in 2023.

People affected

This proposal is expected to limit out-of-pocket drug spending growth for people with Medicare and private insurance and put downward force per unit area on premiums by discouraging drug companies from increasing prices faster than inflation. The number of Medicare beneficiaries and privately insured individuals who would come across lower out-of-pocket drug costs in whatever given year under this provision would depend on how many and which drugs had lower cost increases and the magnitude of price reductions relative to current prices under each provision. Based on our assay, prices accept increased faster than inflation for many Part D covered drugs, suggesting that inflation rebates would produce savings for a large number of Medicare beneficiaries.

budgetary impact

CBO estimates a net federal deficit reduction of $83.6 billion over 10 years (2022-2031) from the drug aggrandizement rebate provisions in the BBBA. This includes cyberspace savings of $49.iv billion ($61.8 billion in savings to Medicare and $7.7 billion in savings for other federal programs, such as DoD, FEHB, and subsides for ACA Marketplace coverage, showtime past $20.ane billion in additional Medicaid spending) and college federal revenues of $34.2 billion.

Previously, CBO estimated savings from the drug inflation rebate provisions in legislation under consideration in 2019 (H.R. 3 and S. 2543, Senate Finance Committee legislation considered in the 116th Congress) amounting to $36 billion for H.R. three (2020-2029) and $82 billion for S. 2543 (2021-2030); 10-twelvemonth savings were estimated to exist lower under H.R. iii because the inflation provision would not utilize to drugs subject to the government negotiation process that would be established by that bill. This same exception applies in the BBBA, just fewer drugs could be exempted because fewer drugs are subject to negotiations in the BBBA than H.R.3.

Effects on Launch Pricing

Drug manufacturers may respond to the aggrandizement rebates by increasing launch prices, which could result in some Medicare beneficiaries and Medicare itself paying higher prices for new drugs, and potentially atomic number 82 to college costs for other payers and privately insured patients. While Function D and commercial insurance plans tin negotiate with drug companies and reject to embrace drugs with very high launch prices, they may accept less leverage in some instances, such as when there are no therapeutic alternatives available or when drugs are covered under a "protected class". If launch prices ascent for Part B drugs, the HHS Secretary would have no authority to negotiate lower prices unless and until the new drug meets the criteria for selection for drug price negotiation nether the separate BBBA provision described above.

(Back to pinnacle)

Cap Out-of-Pocket Spending for Medicare Part D Enrollees and Other Part D Benefit Blueprint Changes

Medicare Part D currently provides catastrophic coverage for loftier out-of-pocket drug costs, merely there is no limit on the full amount that beneficiaries pay out of pocket each year. Medicare Part D enrollees with drug costs high enough to exceed the catastrophic coverage threshold are required to pay five% of their total drug costs in a higher place the threshold unless they authorize for Part D Low-Income Subsidies (LIS). Medicare pays 80% of full costs above the catastrophic threshold (known as "reinsurance") and plans pay 15%. Medicare's reinsurance payments to Part D plans at present business relationship for close to one-half of total Office D spending (45%), up from fourteen% in 2006 (increasing from $6 billion in 2006 to $48 billion in 2020).

Nether the electric current structure of Office D, there are multiple phases, including a deductible, an initial coverage phase, a coverage gap phase, and the catastrophic phase. When enrollees reach the coverage gap benefit stage, they pay 25% of drug costs for both brand-name and generic drugs; plan sponsors pay 5% for brands and 75% for generics; and drug manufacturers provide a 70% price discount on brands (there is no discount on generics). Nether the current benefit design, beneficiaries tin can face up unlike price-sharing amounts for the same medication depending on which phase of the benefit they are in, and can face significant out-of-pocket costs for high-priced drugs considering of coinsurance requirements and no difficult out-of-pocket cap.

provision clarification

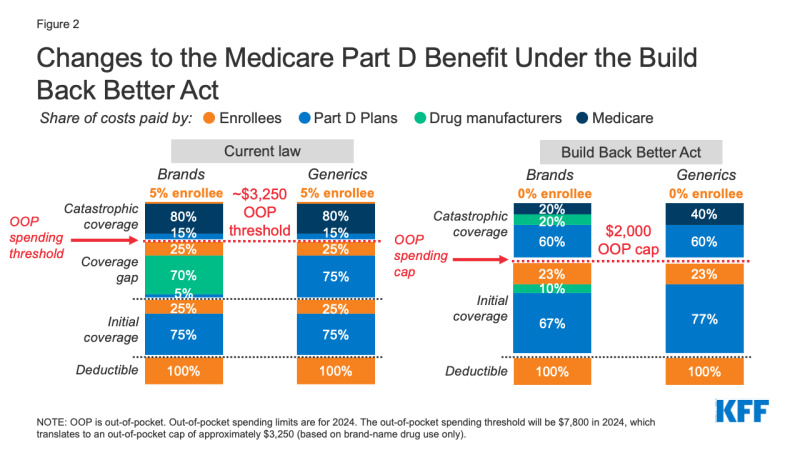

The BBBA amends the design of the Office D do good past adding a hard cap on out-of-pocket spending set at $two,000 in 2024, increasing each year based on the rate of increment in per capita Part D costs (Effigy 2). It also lowers beneficiaries' share of total drug costs below the spending cap from 25% to 23%. The provision lowers Medicare's share of total costs above the spending cap ("reinsurance") from eighty% to 20% for make-name drugs and to 40% for generic drugs; increases plans' share of costs from 15% to sixty% for both brands and generics; and adds a 20% manufacturer price disbelieve on brand-proper noun drugs. The BBBA also requires manufacturers to provide a 10% disbelieve on make-name drugs in the initial coverage phase (below the annual out-of-pocket spending cap), instead of a 70% price discount in the coverage gap phase under the electric current benefit pattern.

Figure two: Changes to the Medicare Part D Benefit Under the Build Back Meliorate Human activity

The legislation increases the Medicare premium subsidy for the cost of standard drug coverage to 76.5% (from 74.5% nether current law) and reduces the beneficiary share of the price to 23.5% (from 25.5%). The legislation also allows beneficiaries the choice of smoothing out their out-of-pocket costs over the twelvemonth rather than face high out-of-pocket costs in any given month.

Effective Date: The Part D do good redesign, including the $2,000 out-of-pocket cap and the premium subsidy changes would take effect in 2024. The provision to smooth out-of-pocket costs would take effect in 2025.

people affected

Medicare beneficiaries in Office D plans with relatively high out-of-pocket drug costs are likely to encounter substantial out-of-pocket cost savings from this provision. This would include Medicare beneficiaries with spending above the catastrophic threshold due to but 1 very loftier-priced specialty drug for medical weather condition such every bit cancer, hepatitis C, or multiple sclerosis and beneficiaries who take a handful of relatively costly make or specialty medications to manage their medical condition.

While near Function D enrollees have non had out-of-pocket costs loftier enough to exceed the catastrophic coverage threshold in a single yr, the likelihood of a Medicare casher incurring drug costs in a higher place the catastrophic threshold increases over a longer time span. Our analysis shows that in 2019, nearly 1.5 million Medicare Function D enrollees had out-of-pocket spending above the catastrophic coverage threshold. Looking over a five-year flow (2015-2019), the number of Office D enrollees with out-of-pocket spending above the catastrophic threshold in at least 1 yr increases to 2.7 million, and over a 10-year period (2010-2019), the number of enrollees increases to 3.6 million.

Based on our analysis, 1.ii million Office D enrollees in 2019 incurred annual out-of-pocket costs for their medications above $2,000 in 2019, averaging $three,216 per person. Based on their average out-of-pocket spending, these enrollees would have saved $ane,216, or 38% of their annual costs, on boilerplate, if a $two,000 cap had been in place in 2019. Function D enrollees with higher-than-average out-of-pocket costs could salve substantial amounts with a $2,000 out-of-pocket spending cap. For instance, the pinnacle x% of beneficiaries (122,000 enrollees) with average out-of-pocket costs for their medications above $two,000 in 2019 – who spent at least $5,348 – would accept saved $3,348 (63%) in out-of-pocket costs with a $2,000 cap.

While a $two,000 out-of-pocket spending cap and the reduction in beneficiary coinsurance from 25% to 23% below the cap are expected to lower out-of-pocket drug spending by Part D enrollees, it is likewise possible that enrollees could face up higher Part D premiums resulting from higher plan liability for drug costs above the spending cap. To mitigate the potential premium increase, the BBBA increased the federal portion of the Medicare premium subsidy from 74.five% to 76.5% and reduced the beneficiary share of cost from 25.5% to 23.5%. Plans could also adopt strategies to do greater control of costs below the cap, such as through more than utilization management or a stronger push for generic utilization, which could too limit potential premium increases.

monetary bear upon

CBO estimates the benefit redesign and smoothing provisions of the BBBA would reduce federal spending by $one.v billion over 10 years (2022-2031), which consists of $1.vi billion in lower spending associated with Part D do good redesign and $0.i billion in higher spending associated with the provision to smooth out-of-pocket costs.

(Back to elevation)

Limit Cost Sharing for Insulin for People with Medicare and Private Insurance

For Medicare beneficiaries with diabetes who apply insulin, coverage is provided under Medicare Part D, the outpatient prescription drug do good. Because Function D plans vary in terms of the insulin products they encompass and costs per prescription, what enrollees pay for insulin products too varies. Insulin coverage and costs besides vary for people with private coverage.

Medicare beneficiaries can choose to enroll in a Part D plan participating in an Innovation Eye model in which enhanced drug plans cover insulin products at a monthly copayment of $35 in the deductible, initial coverage, and coverage gap phases of the Part D benefit. Participating plans exercise not have to cover all insulin products at the $35 monthly copayment amount, just one of each dosage course (vial, pen) and insulin type (rapid-interim, short-acting, intermediate-interim, and long-acting). In 2022, a total of ii,159 Function D plans volition participate in this model, a 32% increment in participating plans since 2021. Based on Baronial 2021 enrollment, 45% of non-LIS enrollees are in PDPs that volition participate in the insulin model in 2022. This model is not available to people outside of Medicare, however. The model was launched in response to rise prices for insulin, which take attracted increasing scrutiny from policymakers, leading to congressional investigations and overall concerns about affordability and admission for people with diabetes who need insulin to control blood glucose levels.

provision description

The BBBA would require insurers, including Medicare Part D plans and private grouping or individual health plans, to charge patient cost-sharing of no more than $35 per month for insulin products. Private group or private plans would not be required to cover all insulin products, just ane of each dosage form (vial, pen) and insulin type (rapid-acting, curt-acting, intermediate-acting, and long-acting), for no more than $35.

Medicare Part D plans, both stand-lonely drug plans and Medicare Advantage drug plans, would exist required to charge no more than than $35 for whichever insulin products they comprehend in 2023 and 2024 and all insulin products beginning in 2025. Coverage of all insulin products would be required starting time in 2025 considering the drug negotiation provision described earlier would crave all Part D plans to cover all negotiation-eligible drugs, and all insulin products are subject to negotiation under that provision.

Effective Engagement: These provisions would take result in 2023.

People affected

A $35 cap on monthly cost sharing for insulin products is expected to lower out-of-pocket costs for insulin users with private insurance and those in Medicare Part D without depression-income subsidies. In 2017, 3.1 million Medicare Part D enrollees used insulin. Amongst insulin users without Role D depression-income subsidies (LIS), boilerplate almanac per capita out-of-pocket spending on insulin increased by 79% over these years, from $324 in 2007 to $580 in 2017. Average annual growth in costs was 6%, which exceeded the 1.6% average annual charge per unit of growth in aggrandizement over this period. If Part D enrollees had paid 12 months of $35 copays for insulin in 2017, annual costs for ane insulin production would take been $420, or $160 (28%) lower than average annual costs paid by non-LIS Part D insulin users in 2017.

According to our analysis of 2019 Role D formularies, a big number of Office D plans placed insulin products on Tier 3, the preferred drug tier, which typically had a $47 copayment per prescription during the initial coverage phase. However, once enrollees reached the coverage gap stage, they faced a 25% coinsurance rate, which equates to $100 or more than per prescription in out-of-pocket costs for many insulin therapies, unless they qualified for depression-income subsidies. Paying a apartment $35 copayment rather than 25% coinsurance or a higher copayment amount could reduce out-of-pocket costs for many insulin products. These provisions are likewise expected to provide savings to millions of insulin users with private coverage.

budgetary affect

CBO estimates additional federal spending of $1.iv billion ($0.9 billion for Medicare and $0.five billion in other federal spending) and a reduction in federal revenues of $iv.6 billion over 10 years associated with the insulin cost-sharing limits in the BBBA.

(Back to top)

Eliminate Toll Sharing for Adult Vaccines Covered Under Role D

Medicare covers vaccines under both Part B and Part D. This separation of coverage for vaccines under Medicare is because there were statutory requirements for coverage of a small number of vaccines under Part B before the 2006 start of the Part D benefit. Vaccines for COVID-19, influenza, pneumococcal disease, and hepatitis B (for patients at loftier or intermediate adventure), and vaccines needed to care for an injury or exposure to disease are covered under Part B. All other commercially bachelor vaccines needed to prevent illness are covered under Medicare Part D.

For the influenza, pneumococcal pneumonia, hepatitis B, and COVID-xix vaccines covered under Medicare Part B, patients currently face no cost sharing for either the vaccine itself or its administration. For other Part B vaccines, such as those needed to care for an injury or exposure to a disease such as rabies or tetanus, Medicare covers 80% of the cost, and beneficiaries are responsible for the remaining xx%. Unlike most vaccines covered under Part B, vaccines covered under Part D can exist subject to toll sharing, because Office D plans have flexibility to determine how much enrollees will be required to pay for any given on-formulary drug, including vaccines. (Part D enrollees who receive low-income subsidies (LIS) generally pay relatively low amounts for vaccines and other covered drugs.) Under Office D, price sharing can take the form of flat dollar copayments or coinsurance (i.e., a per centum of listing toll).

provision clarification

The BBBA would crave that adult vaccines covered under Medicare Part D that are recommended by the Advisory Commission on Immunization Practices (ACIP), such as for shingles, be covered at no cost. This would be consequent with coverage of vaccines under Medicare Part B, such as the flu and COVID-19 vaccines.

Constructive Date: This provision would take effect in 2024.

People affected

Eliminating toll-sharing for adult vaccines covered under Medicare Part D could assist with vaccine uptake amid older adults and would lower out-of-pocket costs for those who need Part D-covered vaccines. Our analysis shows that in 2018, Role D enrollees without low-income subsidies paid an boilerplate of $57 out of pocket for each dose of the shingles shot, which is generally gratuitous to most other people with private coverage.

budgetary impact

CBO estimates that this provision would increase federal spending by $3.3 billion over ten years (2022-2031).

(Back to top)

Repeal the Trump Administration's Drug Rebate Dominion

provision description

The BBBA would prohibit implementation of the November 2020 last rule issued by the Trump Administration that would accept eliminated rebates negotiated between drug manufacturers and pharmacy benefit managers (PBMs) or health plan sponsors in Medicare Part D past removing the rubber harbor protection currently extended to these rebate arrangements nether the federal anti-kickback statute. This rule was slated to have effect on January one, 2022, merely the Biden Administration delayed implementation to 2023 and the infrastructure legislation signed into police force on November 15, 2021 includes a further delay to 2026.

Constructive Date: This provision would take consequence in 2026.

People afflicted

Since the rebate rule never took effect, repealing it is not expected to take a material touch on Medicare beneficiaries. Had the rule taken event, information technology was expected to increase premiums for Medicare Part D enrollees, according to both CBO and the HHS Office of the Actuary (OACT). OACT estimated that a pocket-size grouping of beneficiaries who use drugs with significant manufacturer rebates could have seen a substantial decline in their overall out-of-pocket spending under the dominion, assuming manufacturers passed on price discounts at the point of sale, merely other beneficiaries would have faced out-of-pocket cost increases.

budgetary impact

Because the rebate rule was finalized (although not implemented), its toll has been incorporated in CBO'due south baseline for federal spending. Therefore, repealing the rebate rule is expected to generate savings. CBO estimates savings of $142.6 billion from the repeal of the Trump Administration's rebate rule between 2026 (when the BBBA provision takes upshot) and 2031. In addition, CBO estimated savings of $50.8 billion between 2023 and 2026 for the 3-twelvemonth filibuster of this dominion included in the Infrastructure Investment and Jobs Act. This is because both CBO and Medicare'south actuaries estimated essentially college Medicare spending over 10 years equally a consequence of banning drug rebates nether the Trump Administration's rule – upward to $170 billion higher, co-ordinate to CBO, and up to $196 billion higher, according to the HHS Office of the Actuary (OACT).

This piece of work was supported in part by Arnold Ventures. Nosotros value our funders. KFF maintains full editorial control over all of its policy analysis, polling, and journalism activities.

(Back to summit)

Source: https://www.kff.org/medicare/issue-brief/explaining-the-prescription-drug-provisions-in-the-build-back-better-act/

0 Response to "Does Any Drug Co in the Us Plan to Manfacture Isoprolol Again"

Post a Comment